从天然活性物质含量丰富的基于谷物、植物中提取酚类物质时,离液类物绿色细胞壁的体技紧密排列结构在常规溶剂中难降解是提取不彻底的原因之一,而通过IL破坏细胞壁结构或削弱其分子作用力可明显降低提取阻力。术天以纤维素为例,然酚IL阴阳离子与纤维素相互作用形成共价键,质的制备两者构成络合结构(图2)。高效IL在提取过程中充当纽带,基于促进纤维素溶解,离液类物绿色提高酶解效率。体技

Liu等在IL-水介质中进行酶预处理以提取杜仲中绿原酸,术天对不同阴离子(Cl-、然酚Br-、质的制备NO3-和Tso-)的高效1-烷基-3-甲基咪唑IL进行筛选,结果发现,基于50℃条件下用2mg/mL纤维素酶在[C6mim]Br水溶液(0.5mol/L)中提取2h为最佳,比传统方法耗时更短。封易成等通过对比传统水浸泡法和离子液体酶法两种方法,证明[Bmim]Br除了可以破坏山楂细胞壁,还充当了潜在载体增强纤维素溶解度。在纤维素酶质量分数为1.059%、液料比(mL/g)为29.84∶1,55℃下加热25.3min时具有最佳提取率。

由此可见,IL结合酶解提取天然酚类物质时,一方面IL能提高酶活性、促进细胞壁溶解及降解,另一方面酶解过程改善了IL的不良渗透性。值得注意的是,不同IL溶解各个酶的性能有所差别,导致提取率存在差异。所以在应用该方法时,应考虑酶及IL的种类与溶解度的关系、IL存在下酶的活性等方面的影响,比如可通过选取亲水性IL增强目标物在其水溶液中的混溶能力。

通过物理吸附、化学键合、纳米固载等方法将IL引入不同吸附载体上,制备成一种既有IL独特构型,又具备固相载体特点的新型材料,也称固定化离子液体。固定化离子液体在吸附分离和传质速率上有明显的优势,但稳定性、重复性等问题仍需要进一步完善。

硅胶基质因具有稳定性好、吸附特异性、较高机械强度、无毒等优点,目前已广泛应用于固定化离子液体的制备。Nielr等首次利用离子液体固载硅胶(SiO2·Im+·PF6-)吸附分离丹参粗提液中的酚酸,依次成功分离得到原儿茶醛、丹参素钠、迷迭香酸、紫草酸、丹参酚酸,并且对酚酸分离显示了良好的吸附、解吸和重复利用等性能。此外,同种天然酚类物质在不同种类的固定化离子液体上吸附能力有差异,比如,王志兵等选取[C4mim]Cl、[C6mim]Cl、[C8mim]Cl3种咪唑类IL制备硅胶固载离子液体分散剂分离蜂房中的咖啡酸、阿魏酸、桑色素、白杨素和山柰素,提取率从高到低依次为[C4mim]Cl>[C6mim]Cl>[C8mim]Cl。当[C6mim]Cl添加量为10%时提取率最佳;Du等制备多种硅胶固定化离子液体,应用于阿魏酸、咖啡酸及水杨酸的分离中。比较得出其分离能力高于常用大孔树脂,其中以喹啉类为阳离子、Cl-为阴离子合成的材料对上述3种酚酸分离富集效果最佳,分别为95.84%,89.05%和98.9%。Ge等将由烷基咪唑基阳离子和Cl-、NO3-、BF4-或PF6-等阴离子组成的IL与二氧化硅化学键合为新型吸附剂,动态吸附洗脱试验结果表明,[C8mim]PF6-SiO2材料对木犀草素和芦荟黄素混合溶液中木犀草素的吸附效率和选择性高于纯二氧化硅和其它IL组成的材料,可作为选择分离天然酚类混合物的潜在吸附剂。Liu等应用新型吸附剂-十八烷基咪唑离子液体磁性材料(Fe3O4-SiO2-ImC18)对蜂蜜中的杨素、槲皮素、木犀草素和肉桂中的肉桂酸进行了分析,结果显示干扰物的浓度降低了280倍,加标回收率在85%以上,证明该吸附剂具有良好的富集和除浊性能。

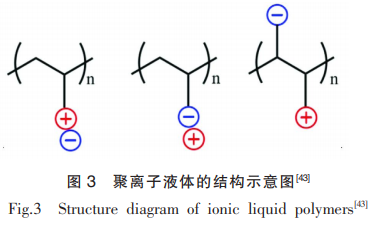

聚离子液体由重复离子液体单体聚合而成,结构如图3所示。Suo等利用不同聚合度长链羧酸离子液体(EVIMCn)与二乙烯基苯(DVB)结合而成的有序介孔吸附材料,装入层析柱中分离从大豆中提取的混合生育酚,试验表明其对混合生育酚的总吸附量高,纯度和回收率均在80%~85%之间,筛选出DVB-EVIMC12为最佳分离材料,经验证其吸附性能显著优于常见树脂材料的吸附性能。

性远超于其它3种,且氢键碱性最弱。将IL-超交联微孔结构聚合物新型吸附材料应用于氢键酸性不同的生育酚同系物的分离中,与非离子液体吸附材料分离性能相比,IL的引入能显著增强分子识别性能,使β、γ、δ生育酚与α-生育酚产生吸附量差异,从而实现高选择性分离。

相关链接:绿原酸,木犀草素,桑色素,迷迭香酸

声明:本文所用图片、文字来源《中国食品学报》,版权归原作者所有。如涉及作品内容、版权等问题,请与本网联系